Investment Vehicle – SCP

Characteristics

- The partnership account (Silent Partnership) is a partnership agreement, simple, objective, widely used in the technology segment. It offers transparency to society, security and cost competitiveness in relation to other investment models, such as FII and FIP;

- At SCP it is possible for silent investors, to audit the accounts at any time, allowing full and unrestricted access to the investments made. It is important to highlight, the the silent

investors will receive monthly reports on the SCP as well as specific reports reporting acquisition and sales of Real Estate. - Moreover, the 2 largest investors of the SCP will be granted seats at the investors committee.

- The management model does not differ much from FII or FIP funds, since it will be the administrators / managers of the SCP, FII or FIP who will make the investments. However, SCP does have a series of launching and maintenance costs, so that it has greater competitiveness in relation to the other two models presented;

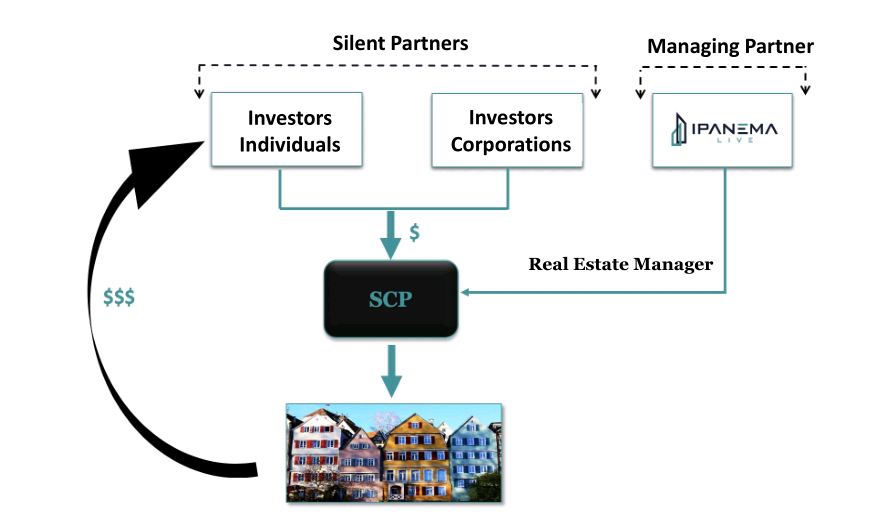

- Ipanema Live is the ostensible partner (Managing Partner), which will manage the investment, in the same way that an FII and FIP manager would do. Therefore, is the SCP who negotiates with third parties, on its own behalf and under its own and exclusive responsibility;

- Managing partners or Silent partners, invest and share the respective results;

- The SCP is governed by the clauses signed by its members (Private Contract), in accordance with articles 991 to 996 of the Brazilian Civil Code;

- Contracting the SCP, a special patrimony is formed, by the contributions of the silent partners. The managing partner will contribute with services and the silent partners with financial resources, kept in a especial separated account, in order to promote the exercise of social activity;

- The managing partner, in the form of article 991 of the Civil Code, is the manager of the activity constituting the object of the SCP, in his individual name and under his own and exclusive responsibility, obliging himself to third parties and taking responsibility in relation to the existing special patrimony;

- The extreme limitation of risks and the non-responsability of the participating partner (in relation to third parties) is what makes the participation account an extremely interesting corporate form, especially as a form of fundraising, since only the managing partner assumes responsibilities before the 3rd parties.

- The Brazilian Civil Code guarantees the hidden (Silent) partner the right to inspect and audit the SCP, but forbids it to intervene in Managing partner’s relations with third parties, under penalty of being jointly liable.

- Financial Security. Investors (silent partners), does not have their names directly associated with the managing partner, therefore they do not return for any debts of it, including consumer, labor and tax;

- Reduction of the tax burden. The profits distributed to the silent partners are exempt from taxation by income tax, and are not subject to tax at source or in the calculation by the beneficiary, individual or legal entity, domiciled in the country or abroad. The taxes inherent to the SCP will be collected by the managing partner, on his behalf, and is lower than it would be if the properties were acquired by an individual.

Terms

| Investment Vehicle | Sociedade em Conta de Participação – Silent Partnership |

| Target | Qualified and unqualified investors, individual or companies, local or foreigners; |

| Benchmark | 100 % CDI (INTERBANK) |

| Managing Partner | Ipanema Realizações Imobiliárias Ltda |

| Performance Fee | 20% of what exceeds benchmark |

| Adm. Fee | 2% a.a. |

| Applications and FAQ | live@ipanema.live |

FAQ

It is an investment vehicle like any other, such as FII (Real Estate Fund) and FIP (Private Shares Investment Fund), however, for many times safer and more competitive in relation to these two and the others.

SCP, as an investment vehicle, has been widely used in technology, in investments in startups, since it gives investors security in relation to the investment and the non-contamination of the rest of the assets by the management of the startup.

Labor processes, for example, the most feared of business management, do not communicate between the investment and the shareholder, this being 100% protected.

The Managing partner manages the business established in the contract, performing all acts on his behalf and under his exclusive responsibility.

The participating/silent partners are investors in the business. In exactly the same way as in a multimarket investment fund, stocks, or even real estate;

Before third parties, with the market for example, the managing partner is solely responsible for any default. Therefore, SCP and the participating/silent partners cannot be involved in any type of process.

The market, suppliers and all kinds of relationships that SCP will have, only see the ostensible partner, the real estate manager, that is, Ipanema Live, and not its shareholders.

Yes, as both are regular investment vehicles on the market.

– Biggest difference: FIP can be traded on the stock exchange;

– SCP’s biggest advantage: friendlier taxation;

Real estate investment funds have various maintenance costs, such as: administration, management and consulting fees, registration fees and custody fees. At SCP, the only maintenance cost is the administration fee to be paid to the ostensible partner.

In addition, as in comparison with FIP, SCP and FII are regular investment vehicles on the market.

– Biggest difference: FII can be traded on the stock exchange;

– SCP’s biggest advantage: friendlier taxation;

As with FII and FIP, there is no possibility of early redemption of investment. In the case of acquisition of properties at auction for resale, the investment will be automatically paid in liquidity events, that is, at each sale of the properties, always in proportion to the share capital of the investing partner;

The quotaholder receives the amounts applied to each liquidity event, that is, each property sold, and automatically;

The shareholder will receive the amounts applied to each liquidity event, that is, each property sold, and automatically;

No, the amounts cannot be reinvested. If the quotaholder wishes to reinvest the profits, he will need to do so via entering a new SCP;

Profit amounts will always be paid for each liquidity event, that is, for each property sale;

The term of the SCPs that Ipanema manages are always related to the sale of all properties, so there is no way that the term of the SCP will end before the totality of the properties is sold;

At the time of signing the contract. The contribution will be made on the date it is hired. If the shareholder has signed a contract committing to the contribution, but does not do so, he will be liable for breach of contract.

SCP’s are treated as equivalent to other legal entities for the purpose of paying income tax, thus, in determining the results and taxing distributed profits, the rules applicable to other legal entities will be observed.

The Federal Revenue Normative Instruction 179/87 states that the ostensible partner is responsible for determining the results, presenting the income statement and collecting all taxes due by the SCP.

The SCP shareholder will not have to pay any IR, even though he must declare the investment profit in the same proportion that was declared by the managing partner.

No. The profits and dividends calculated based on the results calculated and distributed by the company in a holding account, constitute income not subject to the income tax at source, nor will they be included in the income tax calculation base of the beneficiary;

Investors in the holding company (SCP) must include the following text in the IRPF’s declaration of assets and rights: Investment of R $ (Investment amount) as a participating partner, for the payment of (% Percentage) of the special capital of the company in a participation account whose ostensible partner is Ipanema Realizações Imobiliárias.